Overview

Migrant workers commonly send money to family and friends back home. This money is used for basic survival needs, and the use of crypto for this purpose can make the sending of these remittances more affordable and faster.

In the early days of crypto — before DeFi, the metaverse, and NFTs were a thing — remittances were a dominant part of explaining the need for crypto.

Remittances are payments that migrant workers living in one country send back to friends and family in their home country. Generally, workers in more developed economies like the United States and countries in Western Europe regularly send varying sums of remittance payments.

But the means of sending remittances — especially for migrant workers, who often lack full access to banking systems — require the use of costly (in terms of time and money) transfer services.

Early crypto advocates saw digital currencies as an alternative. Using internet-based financial networks opened up platform agnostic, fast, and cost effective ways to send money across borders, without the need for involving third party money transmitters that usually take a cut at both ends of the transaction.

But crypto didn’t kill the traditional remittance business model (at least not yet). The reason? People buying and sending crypto aren’t long term holders or investors. They need a quick and seamless way to move between cash and crypto. But until now, moving money back and forth between cash and crypto was difficult.

The state of global remittances

The amount of money sent through official remittance channels to people in low and middle-income countries in 2022 is expected to top $630 billion, according to estimates by the World Bank.

The $630 billion figure represents a 4.2 percent increase from 2021. And 2021 saw an almost record-breaking year of 8.2 percent increase from the heavy-hit 2020 global pandemic year.

The top five targets for remittance payments in 2021 were India, Mexico, China, the Philippines, and Egypt.

The countries where remittance payments represent a major portion of a country’s GDP include Lebanon (54 percent), Tonga (44 percent), Tajikistan (34 percent), Kyrgyz Republic (33 percent), and Samoa (32 percent), again according to the World Bank report.

The margins matter

In 2021, the average cost of sending a remittance payment of $200 was six percent, according to Remittance Payments Worldwide Database. The target, as defined by the UN’s Sustainable Development Goals is a cost of three percent for workers to send money home.

Where you are sending money matters. The average cost of a remittance transaction to South Asia is 4.3 percent, while it costs 7.8 percent to send money to Sub-Saharan Africa.

Saving just an average of two percent on global remittance payments will translate to $12 billion — money that would become available to migrant workers and their families.

Some of the major reasons why remittances are so expensive is because the money has to pass through multiple systems and service providers — adding both complexity and cost to the transaction.

According to Dilp Ratha, the lead author for the World Bank’s report on migration and remittances, the current global geopolitical landscape, particularly in the context of the war in Ukraine, likely means more instability for money-moving channels. “The cross-border payment systems, however, are likely to become multipolar and less interoperable, slowing progress on reducing remittance fees.”

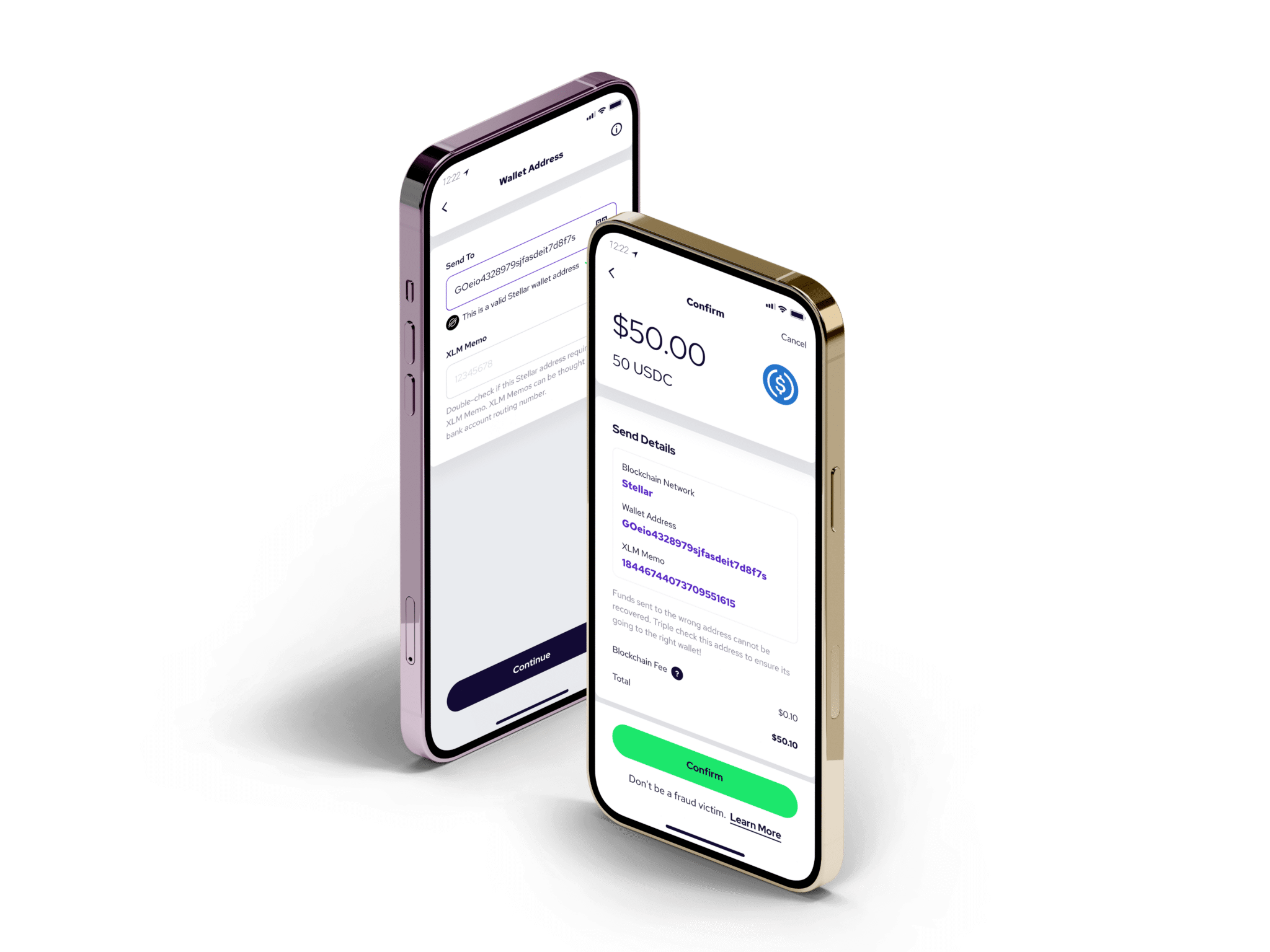

Crypto solves a lot of the interoperability problems. A person sending the money from a developed economy can have one kind of crypto wallet and then send the money to friends and family in another part of the world with a wallet that supports the same crypto, like a stablecoin for example.

And while it seems simple, challenges still exist. In a lot of ways, using crypto as a major remittance corridor is analogous to the “last mile” challenge of designing and implementing easy to use public transportation systems.

As global inflation continues to increase and economic stability continues to decrease, the need to figure out crypto remittances is at an all time high.

Not to mention that handling digitally-based money like crypto is faster, more convenient, and makes it easier to access other financial services. In fact, according to a 2021 Global Findex Database report, financial products designed for mobile devices make money more inclusive. “Mobile money has become an important enabler of financial inclusion in Sub-Saharan Africa—especially for women—both as a driver of account ownership and of account usage through mobile payments, saving, and borrowing.”

Coinme and the last mile

The friction of moving between the cash-based legacy financial system and emerging digital financial systems isn’t just a problem confined just to people making remittance payments.

The challenge of moving between crypto and fiat is also a major bump on the road to mass adoption. And it’s the reason why Coinme has developed a suite of services designed to make the crypto systems easier.

Moving cash to crypto (and back again) has never been easier using Coinme-powered kiosks and services.

Solving crypto’s last mile problem shouldn’t be hard and it shouldn’t be expensive. To find a Coinme-enabled location near you, please visit https://stage.coinme.com/locations/