Summary

In this blog post, we’re covering everything you need to know about Bitcoin ATMs and ID, including what identification you need to use a Bitcoin ATM and the requirements around Bitcoin ATMs and identification.

Bitcoin ATMs are constantly evolving as they aim to make getting into cryptocurrency easier and more accessible. Part of this growth means gaining licensure and following regulations to ensure secure transactions. One of the most prominent regulations Bitcoin ATM providers must follow is requiring their users to share and confirm their identity.

What is a Bitcoin ATM?

Bitcoin ATMs are convenient kiosks that allow users to sell and buy cryptocurrencies like Bitcoin, Ethereum, Dogecoin, Litecoin, and Polygon with cash. They are easy to use and often located in convenient locations like grocery stores or shopping centers. Bitcoin ATMs bring cryptocurrency transactions to millions of people, making the growing crypto economy even more accessible.

Bitcoin ATMs are also incredibly quick and secure. You can sell or buy crypto in moments using cash and don’t need to have any physical cards – like a debit card or ID – with you to make your transactions. Bitcoin ATMs also use blockchain technology to process transactions securely.

Answering your questions about Bitcoin ATMs and ID

There are constant questions swirling around online and within the crypto community about the requirements surrounding Bitcoin ATMs and identification. What type of ID do you need? Why do you need ID, anyway? Check out answers to some of the most common questions below.

Do Bitcoin ATMs require identification?

All licensed Bitcoin ATMs in the United States are required to ask their customers for proof of identification thanks to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations. Typically, Bitcoin ATM operators will ask for a government-issued identification to set up your account.

While many Bitcoin ATMs may ask for proof of identification while using the ATM, others only require you to provide a government-issued identification when you register for an account. Once you have your account, you can exchange crypto for cash at a Bitcoin ATM using your phone and two-factor authentication via SMS or a mobile app.

Anti-Money Laundering (AML)

The Bank Secrecy Act (BSA) is the principal federal regulation that mandates AML processes in the United States. First introduced in the 1970s, the BSA allows the U.S. Department of Treasury to mandate reporting and other requirements on financial institutions to prevent or stop money laundering.

In 2021, the Anti-Money Laundering Act of 2020 went into effect, largely modernizing many aspects of U.S. AML regulations. Among the newly introduced requirements, the Act required cryptocurrency exchanges, art dealers, and private companies to perform the same customer due diligence as financial institutions.

Know Your Customer (KYC)

KYC practices are a piece of AML efforts that fall under customer due diligence. They require institutions subject to AML regulations to gather data on their customers, such as their identification, phone number, or other contact information.

The main purpose of KYC mandates is to protect institutions and their customers from things like fraud, money laundering, corruption, and other illegal activities.

What type of identification do I need to use a Bitcoin ATM?

The type of identification needed to use a Bitcoin ATM depends on the service provider. Most Bitcoin ATMs require users to submit a government-issued ID card, such as a passport or driver’s license to prove their identity. Many also implement other verification methods, such as two-factor authentication or face scanning.

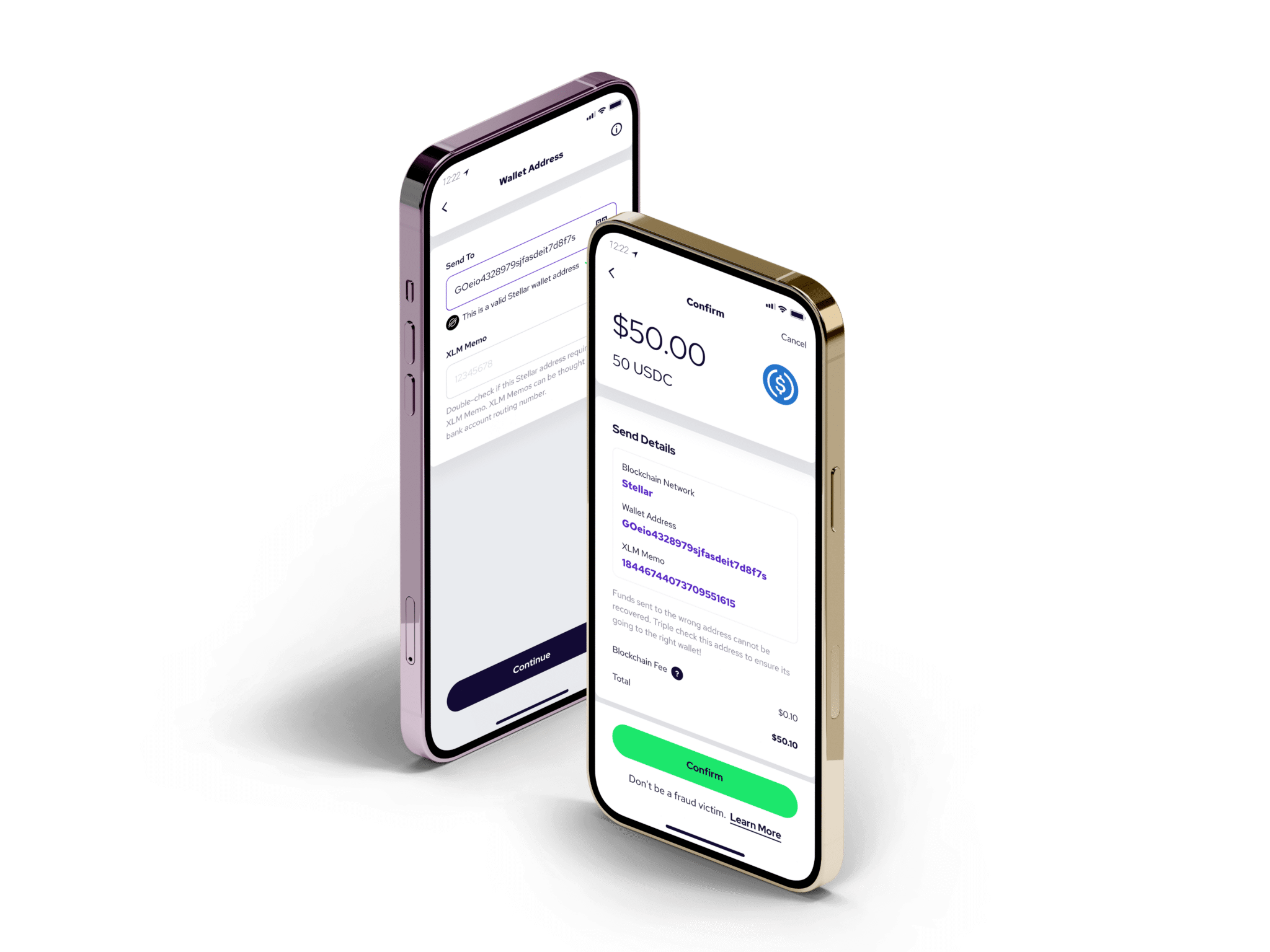

You can learn more about the exact identification you need to use a Bitcoin ATM by checking out your provider’s website. At Coinme, there are several different ways to set up an account, both with and without using a government-issued ID. Once they’re ready to use a Bitcoin ATM, they only need their phone number to run the Coinme mobile app and receive unique access codes.

Why do Bitcoin ATMs require an ID?

Bitcoin ATM providers follow the same laws and requirements of other cryptocurrency exchanges. These anti-money laundering processes, such as performing customer due diligence, require identification.

You should be wary of using a Bitcoin ATM that does not require a form of identification at any step during the exchange process. A Bitcoin ATM that isn’t asking for identification is likely unregulated and unlicensed, making it a risky and possibly dangerous option for you to perform crypto transactions.

How long does it take for a Bitcoin ATM to verify your identity?

In most cases, a Bitcoin ATM can verify your identity in a matter of minutes to seconds, depending on what you’re trying to accomplish.

- Creating an account: It will take Bitcoin ATMs the longest to verify your identity when you first set up an account since this is when you typically share your government-issued ID. Depending on network activity and your Bitcoin ATM provider’s process, this step can take anywhere from 10 seconds to several hours.

- Selling crypto: When you’re selling cryptocurrency via a Bitcoin ATM, you typically need to verify your identity through an SMS code, in-app notification, or Face ID. These methods can verify your identity in seconds.

- Buying crypto: Similar to selling crypto, verifying your identity when buying crypto usually occurs in a matter of moments via two-factor authentication, like unique codes sent via SMS, in-app notifications, or Face ID.

How to Use a Bitcoin ATM Without an ID

Even though we’ve already established that you’ll need some sort of ID to set up your Bitcoin ATM account and crypto wallet, it doesn’t mean you need your ID on hand when you use the Bitcoin ATM to exchange cryptocurrency for cash.

At Coinme, most of our locations allow the purchase of up to $9,500 in crypto per day. All you need is your phone number and the cash you’ll use to make your purchase. Your phone number securely links your purchase with your account, so there’s no need to bring a photo ID or debit card once you already have a Coinme account.

Here’s how it works:

- Visit the Bitcoin ATM you plan to use. You can find a Bitcoin ATM by using a Bitcoin ATM Locator.

- Choose the cryptocurrency you want to purchase.

- Verify your identity using two-factor authentication, usually by receiving a unique code via text message—no need to have a photo ID on hand.

- Insert cash and buy your selected cryptocurrency.

The process is similar if you’re selling crypto for cash at a Bitcoin ATM. All you need to do is initiate the sale in-app, verify your ID at the Bitcoin ATM with a unique cash code delivered via SMS or app notification, and withdraw your cash in moments.

Securely Exchange Crypto for Cash with Coinme

Coinme is proud to have been the first licensed Bitcoin ATM company in the United States. We also operate the largest licensed cryptocurrency cash exchange in the U.S. and are licensed and registered with the Financial Crimes Enforcement Network as a money service business.

We take safety and security seriously so that we can provide our customers with trustworthy and dependable services, which is why we’ll always ask you to provide identification when setting up your account.

If you’re ready to start exchanging crypto for cash using a platform that is easy, accessible, and secure, create a free account today.