Summary

The main reason Bitcoin ATMs have limits is to protect against fraud. Unfortunately, there have been many fraudulent incidents involving scammers that play on people’s emotions, asking them to send thousands in crypto via Bitcoin ATMs. Having limits on the amount users can sell and receive protects them from fraud.

Converting cryptocurrency to cash (or vice versa) has never been easier now that thousands of Bitcoin ATMs are available across the globe. The conveniently located kiosks bridge the gap between the intangible cryptocurrency world and the tangible feeling of cash in your hand. The concept is exciting to many, and perhaps it is for you, too! But, before you go buying $20,000 worth of Ethereum at your local Bitcoin ATM, there’s one thing you should learn about first – Bitcoin ATM limits.

Background on Bitcoin ATMs

Bitcoin ATMs have been around since 2013 and have grown increasingly more popular since then. They offer an easy and accessible way for anyone to buy and sell crypto with cash. Most Bitcoin ATMs allow users to transact multiple forms of cryptocurrency – such as Bitcoin, Ethereum, Stellar Lumens, Dogecoin, and more.

Bitcoin ATMs work by using two-factor authentication that gives users access to their crypto wallets so they can purchase or cash out crypto. They’re typically located in convenient locations like shopping malls, grocery stores, or coffee shops and charge a small fee to cover costs like maintenance and security.

Why do Bitcoin ATMs Have Limits?

While many users may question why limits exist on Bitcoin ATM transactions, they do have a purpose! Believe it or not, these limits are mainly there for your protection.

Security

The main reason Bitcoin ATMs have limits is to protect against fraud. Setting withdrawal limits can protect users if someone gains access to their accounts, as it restricts the amount that can be withdrawn at once, safeguarding against potential theft or scams involving unauthorized access to their crypto keys. Unfortunately, there have been many fraudulent incidents involving scammers that play on people’s emotions, asking them to send thousands in crypto via Bitcoin ATMs. Having limits on the amount users can sell and receive protects them from fraud. Standard bank ATMs also have withdrawal and deposit limits for similar reasons – so it’s nothing out of the ordinary for Bitcoin ATMs to do the same.

Regulations

The Anti-Money Laundering Act of 2020 required all cryptocurrency exchanges – including Bitcoin ATMs – to implement stronger anti-money laundering (AML) practices. Among these practices was the requirement to collect information about users and submit written AML plans. Depending on the amount being spent or withdrawn, a driver’s license may be required for transactions. Many states also regulate Bitcoin ATM limits. For example, California recently passed a law limiting the amount you can withdraw from a Bitcoin ATM.

Utility

Bitcoin ATMs operate on the premise that you can have cash in hand within moments. However, delivering on that promise becomes difficult if there’s no cash in the kiosk. A lot of Bitcoin ATMs also implement limits on withdrawals to ensure there’s enough cash to cover every potential sales transaction that may occur before they’re able to restock.

Who Sets Bitcoin ATM Limits?

Bitcoin ATM limits are decided by a variety of different parties, including Bitcoin ATM operators and Federal and State laws.

Bitcoin ATM Operators

Depending on the company, crypto ATM and Bitcoin ATM operators will typically implement maximum limits between $3,000 – $10,000. Many Bitcoin ATMs also have minimum limits, but this varies greatly depending on the provider. The biggest reason a Bitcoin ATM places limits on their machines is to ensure there is enough cash in a kiosk at any one time. They also do it to protect their customers.

State and Federal Governments

Apart from Bitcoin ATM operators, State and Federal governments also implement regulations regarding Bitcoin ATM limitations. Limits set by the government are generally put in place to prevent fraud and protect consumers. The Financial Crimes Enforcement Network—FinCEN for short—is the main Federal bureau that regulates Bitcoin ATMs. They work to prevent money laundering and other financial crimes.

Bitcoin ATM Limits in the United States

Bitcoin ATM limits in the United States vary depending on your state and the Bitcoin ATM you use. In general, you can expect to see ATM daily limits between $3,000 and $10,000 when you purchase crypto at a Bitcoin ATM. However, State laws can affect these limits.

- In California, Senate Bill 401 was recently passed, limiting the maximum amount you can purchase or sell with cash at a Bitcoin ATM to $1,000 starting in 2025

- In Connecticut, an amendment to an existing house bill limited daily Bitcoin ATM transactions to $2,500 per person

Many other states are also considering implementing limits on Bitcoin ATM kiosks as they become more popular across the country.

Bitcoin ATM Limits Across the World

The United States isn’t the only country with Bitcoin ATMs. You can find them across the world, and every country has different laws about limits.

Europe

The European Union (EU) has been busy passing regulations on cryptocurrency exchanges, which include Bitcoin ATMs. In 2023, the EU released the Markets in Crypto-Assets Regulation (MiCA), the first guidance of its kind to institute uniform market rules for crypto-assets in the EU.

In January 2024, the EU reached an agreement to limit crypto-to-cash transactions to 10,000 euros. The idea behind this limit was to prevent money laundering schemes. Firms are also required to verify the identities of people who regularly perform crypto-to-cash transactions between 3,000 and 10,000 euros.

Canada

Canada has the largest number of Bitcoin ATMs after the United States. It’s also home to the first-ever Bitcoin ATM kiosk. Being the home of innovation that it is, Canada’s government hasn’t done much in the way of putting limits on Bitcoin ATMs. Instead, they’ve mostly left it up to each province or territory. Of course, Bitcoin ATM operators can also set limits, which they do. In Canada, you can expect to see daily transaction limits up to around 10,000 CAD.

Bitcoin ATM Withdrawal Limits

Bitcoin ATM withdrawal limits are a crucial aspect of the bitcoin ATM industry, designed to prevent excessive withdrawals and ensure the security of user accounts. Most bitcoin ATMs have withdrawal limits in place, which can vary depending on the bitcoin ATM operator and the location of the machine. For instance, some bitcoin ATM companies may set a maximum limit of $10,000 per day, while others might have a lower limit of $3,000 per day. Understanding these limits is essential for users who want to buy or sell bitcoin using a bitcoin ATM. These limits not only help in managing the cash flow within the machines but also play a significant role in protecting users from potential fraud and ensuring compliance with regulatory standards.

Factors Affecting ATM Limits

Several factors can influence bitcoin ATM limits, including the policies of the bitcoin ATM operator, the location of the machine, and regulatory compliance requirements. Bitcoin ATM operators must adhere to anti-money laundering regulations, which can impact the limits they set for their machines. Additionally, the minimum purchase amount and identity verification requirements can also affect the limits. For example, some bitcoin ATMs may require users to provide a phone number or undergo ID scan verification to increase their daily limit. Other factors, such as the type of cryptocurrency being purchased and the user’s transaction history, can also play a role in determining the limits. These measures ensure that transactions are secure and compliant with legal standards.

Limits for Purchasing vs. Selling with a Bitcoin ATM

You’ll find that most Bitcoin ATM limits apply to total transactions instead of setting separate limits for withdrawals and purchases. To learn more about the limits of the Bitcoin ATM you plan to use, check the operator’s website.

No matter the limits your Bitcoin ATM has, knowing how to use a Bitcoin ATM is a crucial part of the equation.

How to Buy Crypto with Cash

Buying cryptocurrency with cash at a Bitcoin ATM is easy and fast. Just follow these steps.

- Create an account with the Bitcoin ATM operator you plan to use

- Go to the Bitcoin ATM and enter your phone number

- Verify your identity with two-factor authentication

- Select the cryptocurrency you wish to buy

- Insert cash – make sure you know the maximum if you’re looking to buy a lot

- See the crypto in your crypto wallet in moments

How to Sell Crypto for Cash

Bitcoin ATMs offer an easy and accessible avenue for quickly cashing out your crypto holdings.

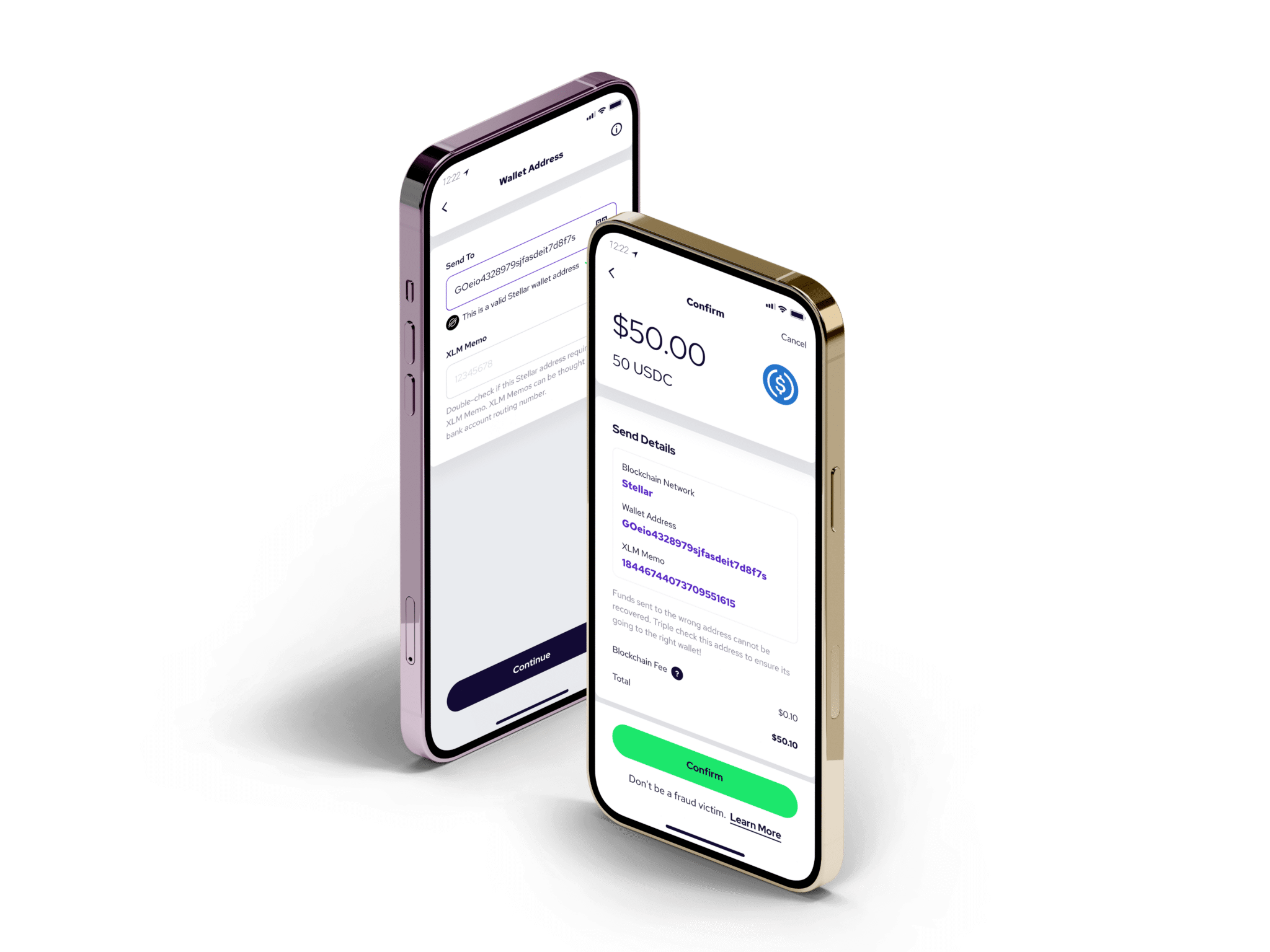

- Ensure you have funds in your crypto wallet

- Initiate the sale of your crypto in the Bitcoin ATM mobile application to receive a unique cash code

- Go to the Bitcoin ATM and enter your cash code

- Verify your identity with two-factor authentication

- Receive cash in seconds

Transaction Limits and User Verification

Transaction limits and user verification are closely linked, as bitcoin ATM operators use verification processes to ensure that users are legitimate and to prevent money laundering. The level of verification required can vary depending on the transaction size and the user’s history with the bitcoin ATM operator. For instance, a user who wants to purchase a large amount of bitcoin may need to provide more extensive verification, such as a driver’s license or passport, to increase their daily limit. Conversely, a user who only wants to purchase a small amount of bitcoin may only need to provide a phone number or undergo SMS verification. Bitcoin ATM operators employ various verification methods, including ID verification, photo ID verification, and QR code verification, to ensure that users are who they claim to be. These measures help maintain the integrity and security of transactions.

Managing Bitcoin ATM Limits

Managing bitcoin ATM limits is crucial for bitcoin ATM operators, as it helps prevent excessive transactions and ensures regulatory compliance. Bitcoin ATM operators must balance the need to provide convenient and seamless transactions with the need to prevent money laundering and protect user accounts. To achieve this balance, bitcoin ATM operators use various internal controls, such as daily transaction limits and identity verification requirements, to manage their limits. Additionally, bitcoin ATM operators must ensure that their machines comply with federal regulations and that they have a robust AML program in place. By managing their limits effectively, bitcoin ATM operators can provide a secure and convenient way for users to purchase and sell bitcoin, while also protecting themselves and their users from potential risks.

Buy and Sell Crypto with Cash via Coinme

While Bitcoin ATM limits can seem like a hindrance, their benefits heavily outweigh any drawbacks. Bitcoin ATM limits protect customers and companies from fraudulent scams, money laundering, and more. As regulators continue to implement protections, limits may change, so it’s always best to double-check your Bitcoin ATM’s limit before making a transaction.

At Coinme, our Bitcoin ATMs allow you to purchase up to $9,500 worth of crypto each day (unless State laws mandate a lower limit). We also boast the largest cryptocurrency cash network in the world, with over 40,000 locations where you can buy and sell crypto with cash.

If you’re ready to start buying and selling crypto with Coinme, create an account now.