Credit unions are among the lesser-known financial institutions for younger generations. According to CU Collaborate, the average age of a credit union member is 47. The average age of all Americans is 37 years old. Credit union members are typically more senior than the rest of the U.S. population.

This statistic is particularly alarming because credit unions are slow to acquire millennial and Gen Z customers while their core members are aging. According to GoBankingRates, people ages 35 to 44 drastically favor online banks (36%) compared to credit unions (19%).

Credit unions are losing market share to online banks. It’s apparent that credit unions need to find ways to adapt to changing consumer preferences.

Transition to digital banking

Credit unions need to transition their banking platform to a digital one to compete with national and challenger banks.

Matthew Williamson, VP of global financial services at Mobiquity, reiterates the opportunity for digital transformation of credit unions:

“[This] is an opportunity for credit [unions] to reposition themselves embracing digital.” – Matthew Williamson

Credit unions need to be innovative and bring new products to their platform. If they continue relying on their current products and services, they will have trouble acquiring younger customers. They will be left behind when competing with innovative digital banks.

Credit unions can innovate with crypto

Adding cryptocurrency to your banking platform can give your credit union a competitive edge.

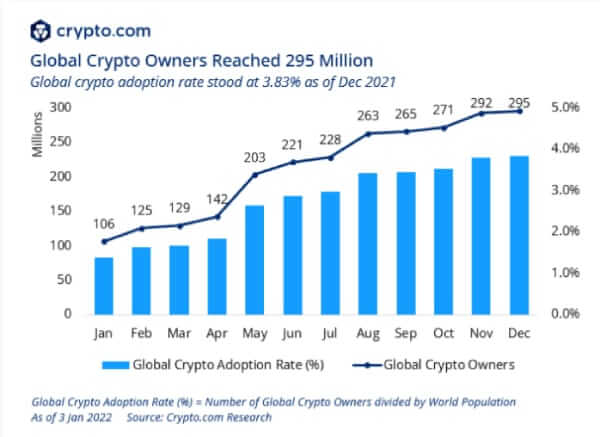

Cryptocurrency is one of the fastest-growing technologies in human history. According to Crypto.com, the global crypto population increased 178% in 2021, rising from 106 million in January to 295 million in December.

Cryptocurrency is gaining momentum quickly. The adoption of crypto is growing faster than the early Internet. Institutions that adopt crypto will be able to benefit from the growth in the future.

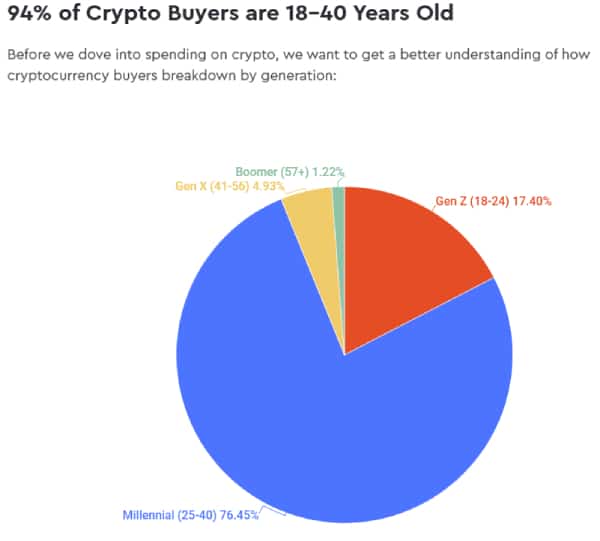

It’s no secret that cryptocurrency has gone mainstream for younger generations, such as millennials and Gen Z. According to Stilt, 94% of crypto buyers are between the ages of 18 and 40.

It’s hard to ignore crypto adoption among millennials and Gen Z. They are the first digitally native generations, so they understand the value of digital assets.

Millennials and Gen Z trust the financial institutions that they use for banking. They don’t want to trust another third party to access cryptocurrencies. These generations want to trade cryptocurrencies directly in the banking application on their phone or computer.

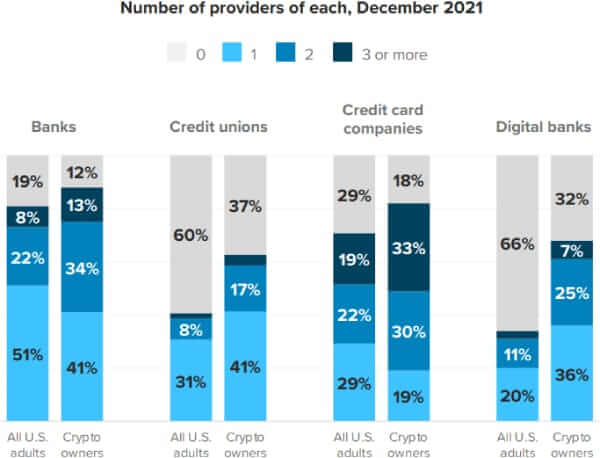

Additionally, cryptocurrency owners are more likely to become members of credit unions. In the United States, 31% of all adults use at least one credit union. For cryptocurrency owners, 41% are members of at least one credit union (see chart below).

Consumers are demanding cryptocurrency products. They want to be part of the rapidly growing industry. If their current bank or credit union doesn’t offer crypto, they will simply switch to a new platform.

The crypto opportunity

There is an opportunity for credit unions to add cryptocurrency directly to their banking platform.

Below are many benefits to adding cryptocurrency to credit unions:

- Acquire younger customers who are attracted to cryptocurrency

- Retain existing deposits that were moving to crypto exchanges

- Generate a new revenue stream through crypto transaction fees

According to the National Credit Union Administration, “Credit unions with federally insured deposits can work with third-party providers of crypto services to allow their members to purchase, sell, and hold digital assets if certain conditions are met.”

Your credit union can add seven cryptocurrencies to your platform using Coinme’s APIs. There are no hidden integration fees, just crypto accessible to your customers. You can find more details to partner with us on our website here. The time to add crypto is now. It is becoming clear that financial institutions have to adopt this technology to stay competitive and not be left behind.