Most financial institutions need backend systems to provide banking services such as savings accounts, lending, and card processing. It’s challenging to develop these services in-house since they require many resources.

Many financial institutions use a core banking services provider to implement their banking services. Some examples of these service providers include Fiserv, FIS, and Finastra. These companies give banks and credit unions a technology stack to build their digital platform. According to Synctera, the Banking-as-a-Service market is expected to grow to more than $25 billion by 2026.

Banks and credit unions are demanding more products and services from their providers. They must meet all their customers’ needs to stay relevant in the marketplace.

Financial institutions need to innovate

Banks and credit unions are experiencing a massive transition to digital banking. Neobanks and challenger banks are taking market share quickly.

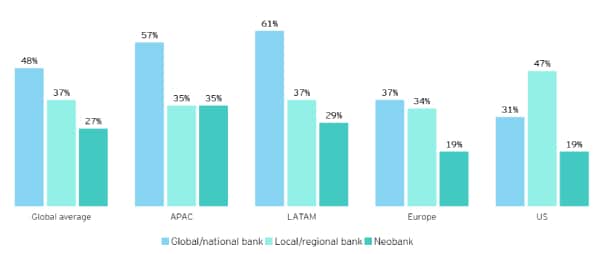

According to Ernst Young, the current neobank market share is 27% globally compared to 37% for local banks and 48% for global banks.

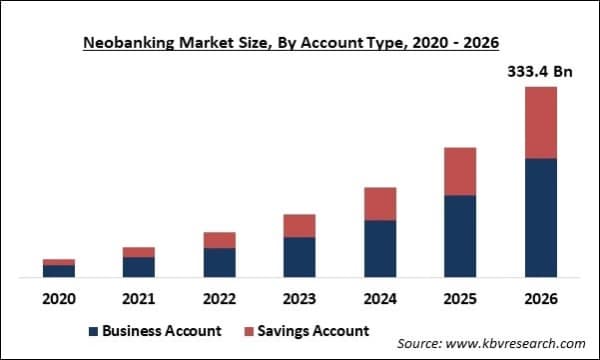

Neobank’s market share will grow in the future. According to KBV Research, the neobank market will grow past $330 billion by 2026.

Banks and credit unions need to change their strategy to compete with neobanks. They have to continue to add competitive products, so they don’t lose market share to their digital counterparts. They can add these innovative products directly to their platform by working with their core banking services provider.

Banking integrators can add crypto

Banking system integrators need to add products to their technology stack to allow their banks to retain their customers. Most banking providers have similar products, such as checking and savings accounts, so it can be challenging to differentiate them from each other. One way banking integrators can differentiate is by adding crypto for their clients.

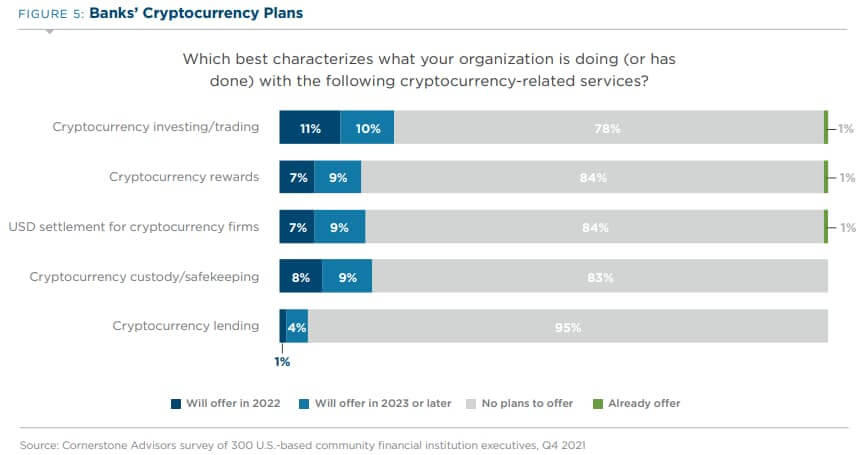

Banks have realized that they need to add cryptocurrency to their platform. According to Cornerstone Research, 21% of banks plan on adding cryptocurrency investing to their banking platform within the next two years.

Cash App isn’t the only digital wallet that had success by adding cryptocurrency. In October 2020, PayPal allowed its users to buy, hold, and sell crypto on their platform.

In response, PayPal saw incredible platform engagement immediately after launch. PayPal reported a 3x higher usage frequency for bitcoin traders than non-bitcoin traders. Shortly after adding crypto to PayPal, the company added crypto to Venmo.

Adding cryptocurrency has been a massive success for these digital wallets. It has increased revenue and platform engagement for both Cash App and PayPal. Adding crypto to digital wallets will benefit businesses.