Cryptocurrency custody is crucial when deciding whether to add crypto to your platform. The OCC clarified regulations around bank crypto custody last year. In July 2021, the OCC published a letter stating that all nationally chartered banks in the U.S. can provide crypto custody services. This opened up the doors for banks to provide custody on their own.

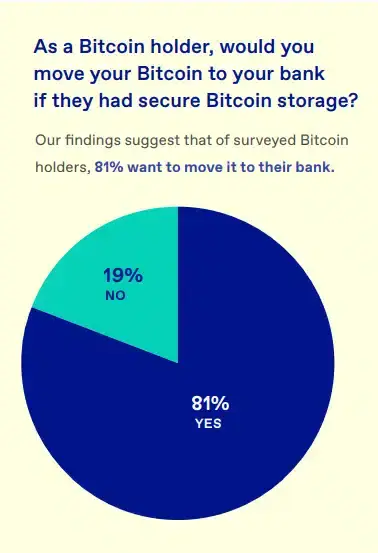

According to the Bitcoin + Banking survey, over 81% of bitcoin holders surveyed said they would move their bitcoin to their bank if they had secure bitcoin storage.

Banking customers are demanding crypto custody inside their banking platform. It’s simply too cumbersome for customers to keep moving money from their bank accounts to crypto exchanges when they want to trade. Having crypto inside banking platforms discourages customers from withdrawing deposits to exchanges.

However, just because banks can have custody of cryptocurrencies doesn’t mean they should. The custody of cryptocurrency can be complex and risky. There must be secure private key management to ensure that nobody can steal the funds. Also, allowing users to transfer crypto to other wallets raises anti-money laundering and sanctions concerns. Transactions must be monitored so crypto won’t be sent to bad actors. This infrastructure needs to be put in place before banks can custody cryptocurrency.

Fortunately, banks have another option to custody crypto: working with a third-party solution provider. Having a third-party take custody of the crypto eliminates the complexity and risk of the custody process. Third-party solution providers already have the infrastructure set in place so financial institutions can accelerate their crypto product launch timeline.

Ramine Bigdeliazari, director of product management for Fidelity Digital Assets, agrees that third parties can be an alternative to self-custody crypto assets:

“While there are a handful of ways that banks could enter the digital asset market, like building an end-to-end solution or acquiring existing providers, sub-custodial relationships with existing and trusted service providers could provide a superior alternative that allows for a quick and proven path to market to meet clients’ needs.” – Ramine Bigdeliazari told CoinDesk

Coinme can take custody of your customers’ crypto assets, so you don’t have to worry about certain compliance risks. We can provide secure custody so you can focus on your customer experience. If you want to learn more about how Coinme can take custody of your customer’s crypto, check out our website here.

Crypto custody is an issue for many financial institutions, but Coinme is here so that you can launch your crypto product without worry and hassle.