Converting your Bitcoin into cash doesn’t have to be complicated. Today, you can cash out Bitcoin instantly at over 20,000+ locations nationwide through Coinme’s ATM network, or use exchanges, P2P platforms, and other methods based on your needs. Whether you’re taking profits, paying bills, or diversifying your portfolio, this complete guide walks you through all your options, with special focus on the fastest and most convenient solutions.

Why cash out Bitcoin?

Bitcoin’s digital nature makes it an excellent store of value and investment vehicle, but sometimes you need traditional cash. Here are common reasons people convert their bitcoin to cash:

- Everyday expenses – Bills, groceries, and daily costs still mostly require traditional currency

- Locking in profits – When Bitcoin prices rise, many investors cash out some holdings to secure gains

- Emergency needs – Life’s unexpected expenses sometimes require immediate access to cash

- Diversification – Balancing cryptocurrency investments with traditional assets

- Major purchases – Down payments on homes or vehicles often require cash

The right cash-out method depends on your specific needs – how quickly you need the money, how much you’re converting, and what level of privacy you require. Let’s explore your options.

Four ways to cash out Bitcoin in 2025

Each method of converting Bitcoin to cash offers different advantages in terms of speed, convenience, fees, and privacy. Understanding all available options helps you choose what’s best for your situation.

Instant cash at Bitcoin ATMs and kiosks

Bitcoin ATMs provide the fastest path to physical cash for your cryptocurrency. These machines allow you to sell Bitcoin and receive cash immediately – perfect when you need money now rather than waiting days for bank transfers.

Coinme powers over 20,000+ Bitcoin cash-out locations across the US through its network of ReadyCode ATMs, making this option incredibly accessible for most Americans.

The process works in a few simple steps:

- Initiate a sell transaction in the Coinme app

- Select how much Bitcoin to convert to cash

- The app generates a unique cash pickup code

- Visit your selected ATM or MoneyGram location

- Enter your code and receive cash immediately

Bitcoin ATMs shine when you need cash quickly without bank involvement. They’re particularly valuable for the underbanked population or during situations when waiting days for bank transfers isn’t practical.

Current bitcoin price

Online cryptocurrency exchanges

Centralized exchanges represent the most common way to convert larger amounts of Bitcoin to cash. These platforms connect directly to your bank account, allowing you to sell Bitcoin and withdraw the proceeds.

The typical process involves:

- Creating an account and completing identity verification

- Linking your bank account to the exchange

- Transferring Bitcoin to your exchange wallet

- Selling Bitcoin for your local currency

- Withdrawing funds to your bank account

While exchanges typically offer competitive rates, the main drawback is processing time. Bank transfers usually take 1-5 business days to complete, making exchanges less suitable when you need immediate cash.

Exchanges work best for those who don’t need immediate access to funds and are converting larger amounts where competitive rates outweigh convenience factors.

Bitcoin debit cards

While not directly “cashing out,” Bitcoin debit cards provide a practical way to spend your cryptocurrency at any merchant that accepts traditional payment cards.

These cards work by:

- Loading your Bitcoin onto the card platform

- Converting to fiat currency automatically when you make purchases

- Functioning like a regular debit card for payments

This approach bridges the gap between cryptocurrencies and everyday spending, though each transaction typically incurs conversion fees and creates taxable events.

Direct bank deposits through wallet services

Some wallet providers and services now offer direct selling and bank deposit features within their platforms. These services simplify the process by handling both the Bitcoin sale and the bank transfer in one integrated experience.

This method appeals to those who prefer managing everything in a single application, though it typically doesn’t offer the immediate access to cash that ATMs provide.

How to cash out Bitcoin with Coinme

Coinme offers one of the most straightforward ways to convert Bitcoin to cash through its extensive network of ATMs. Here’s how to use this method:

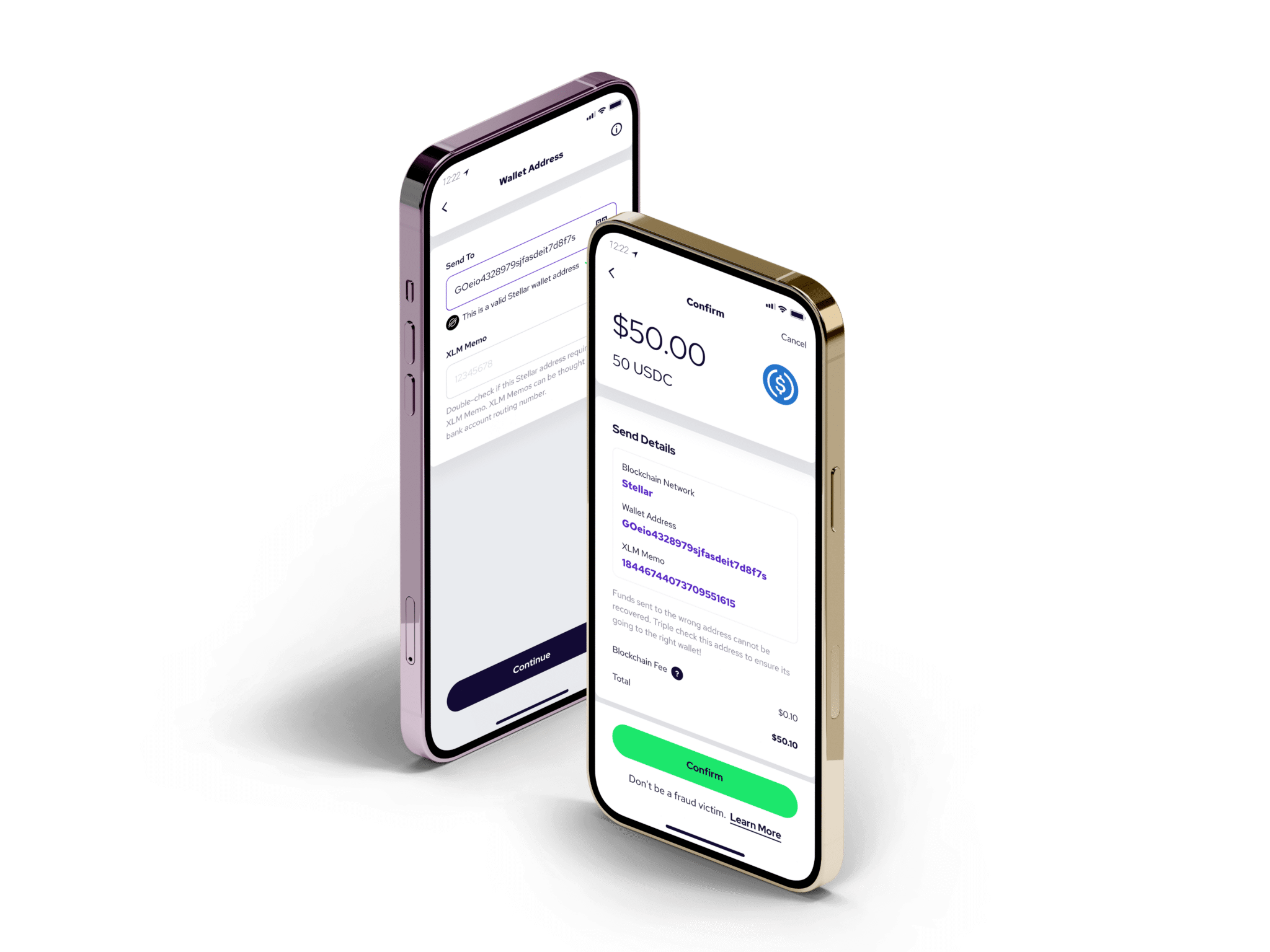

ReadyCode ATM method

- Open the Coinme app on your smartphone

- Select “Sell” from the transaction options

- Choose your Bitcoin amount to convert to cash

- Confirm the transaction details, including our competitive fee structure

- Receive a cash code in the app

- Visit any ReadyCode ATM location (shown in the app)

- Enter your cash code at the ATM

- Collect your cash immediately

The entire process takes just minutes from app to cash in hand, making it significantly faster than waiting for bank transfers from exchanges.

Important considerations when cashing out Bitcoin

Converting Bitcoin to cash involves several important considerations beyond just choosing a method. Understanding these factors helps ensure a smooth experience:

Security best practices

When cashing out Bitcoin, security should be your top priority:

- Use trusted platforms with proven security records

- Enable two-factor authentication on all accounts

- Verify all transaction details before confirming

- Be wary of phishing attempts targeting crypto users

- Never share your private keys or seed phrases

Coinme prioritizes security with secure custody solutions, and comprehensive identity verification processes to protect your assets during the cash-out process.

Tax implications

Converting Bitcoin to cash typically creates a taxable event in most jurisdictions:

- Sales are generally subject to capital gains tax based on how long you’ve held the asset

- Keep detailed records of all transactions, including dates and amounts

- Consider tax-loss harvesting strategies when appropriate

- Consult with a tax professional familiar with cryptocurrency regulations

While Coinme can’t provide tax advice, we recommend maintaining thorough transaction records to simplify your tax reporting obligations.

Verification requirements

Most legitimate services require identity verification to comply with regulations:

- Government-issued ID is typically required

- Proof of address may be needed for higher limits

- Verification tiers often determine transaction limits

- Prepare documentation in advance to avoid delays

Coinme implements a streamlined verification process that balances regulatory compliance with user convenience, allowing you to access our services quickly while maintaining appropriate safeguards.

Comparing Bitcoin Cash-Out Methods

When deciding how to cash out your Bitcoin, consider these key factors:

| Method | Speed | Convenience | Privacy | Best For |

|---|---|---|---|---|

| Bitcoin ATMs | Immediate | High | Moderate | Need cash now |

| Exchanges | 1-5 days | Medium | Low | Better rates, larger amounts |

| P2P Platforms | Varies | Low-Medium | High | Payment method flexibility |

| Debit Cards | Immediate spending | High | Low | Everyday purchases |

| Bank Deposits | 1-3 days | Medium | Low | Convenience |

Coinme's ATM option excels in the speed and convenience categories, making it ideal when these factors are your priority.

Why choose Coinme for cashing out Bitcoin

Coinme offers several distinct advantages for converting your Bitcoin to cash:

Unmatched accessibility

With over 20,000+ locations nationwide, Coinme operates one of the largest cryptocurrency cash networks in the United States. Most Americans have a Coinme location within a reasonable distance of their home, making cash access incredibly convenient.

Instant access to funds

Unlike exchanges where bank transfers can take days, Coinme provides immediate cash conversion. This speed is invaluable during emergencies or when timing is critical.

User-friendly experience

Coinme’s mobile app guides you through each step of the process with clear instructions and an intuitive interface. The entire experience is designed to be welcoming to both crypto novices and experienced users.

Trusted partnerships

By partnering with established financial service providers and leading retail brands, Coinme offers a familiar and trustworthy experience in a space often perceived as complex.

Regulatory compliance

As one of the first licensed Bitcoin ATM operators in the United States, Coinme maintains strict compliance with relevant regulations, providing users with confidence in the legitimacy and security of their transactions.

Conclusion

Cashing out Bitcoin has never been easier or more convenient than it is in 2025. Whether you need immediate access to physical cash through Coinme’s extensive ATM network, prefer the competitive rates of online exchanges, or value the flexibility of peer-to-peer platforms, there’s a solution that fits your specific needs.

Coinme’s network of ReadyCode ATMs provides the fastest path to converting your Bitcoin into cash, with over 20,000+ locations nationwide offering immediate access to your funds. This unmatched convenience, combined with our commitment to security and regulatory compliance, makes Coinme the preferred choice for anyone looking to bridge the gap between digital assets and physical currency.

Start by downloading the Coinme app today to discover just how simple it can be to transform your Bitcoin into cash whenever and wherever you need it.

Frequently asked questions.

What does cashing out Bitcoin mean?

Cashing out Bitcoin refers to the process of converting your cryptocurrency into traditional (fiat) currency like US dollars. This can be done through various methods including Bitcoin ATMs, online exchanges, peer-to-peer platforms, or direct bank transfers. The goal is to transform your digital asset into a form that can be easily used for everyday transactions or held in traditional financial accounts.

Can you cash out Bitcoin for real money?

Yes, Bitcoin can absolutely be converted to real (fiat) money. There are multiple established methods to turn your Bitcoin into cash, including Bitcoin ATMs like those powered by Coinme, cryptocurrency exchanges, peer-to-peer platforms, and Bitcoin debit cards. Each method offers different advantages in terms of speed, convenience, and fees, but all provide legitimate ways to convert your digital currency into physical cash or bank deposits

How long does it take to cash out Bitcoin?

The time to cash out Bitcoin varies significantly depending on your chosen method:

- Bitcoin ATMs (Coinme): Immediate cash access (minutes)

- Cryptocurrency exchanges: 1-5 business days for bank transfers

- Peer-to-peer platforms: Varies from minutes to days depending on the buyer

- Bitcoin debit cards: Immediate for purchases, 1-3 days for ATM withdrawals

- Direct bank deposits: Typically 1-3 business days

Coinme's ATM option provides the fastest access to physical cash when compared to other methods.

Is it safe to cash out Bitcoin at an ATM?

Yes, cashing out Bitcoin at a licensed and regulated ATM provider like Coinme is safe. We implement multiple security measures including secure wallet infrastructure and thorough identity verification processes. The key is choosing a reputable provider that maintains compliance with relevant regulations and employs strong security practices. Coinme's status as one of the first licensed Bitcoin ATM operators in the United States demonstrates our commitment to security and regulatory compliance.

What verification is needed to cash out Bitcoin?

Verification requirements typically include:

- Government-issued photo ID (driver's license, passport)

- Phone number verification

- Email verification

- Proof of address (for higher limits)

Requirements vary by provider, with higher transaction amounts generally requiring more extensive verification. These measures exist to comply with anti-money laundering (AML) and know-your-customer (KYC) regulations. Coinme implements a streamlined verification process that balances regulatory requirements with user convenience.

Do I have to pay taxes when I cash out Bitcoin?

In most jurisdictions, including the United States, selling Bitcoin for cash is likely considered a taxable event. The profit or loss (calculated as the difference between your purchase price and selling price) is typically subject to capital gains tax. The specific rate depends on how long you held the Bitcoin and your tax bracket. It's important to maintain detailed records of all cryptocurrency transactions and consult with a tax professional for guidance specific to your situation.

What's the difference between selling Bitcoin on an exchange vs. an ATM?

The primary differences between exchanges and ATMs for cashing out Bitcoin are:

Cryptocurrency Exchanges:

- Access funds in 1-5 business days via bank transfer

- Often have lower percentage-based fees

- Require bank account linkage

- Better rates for larger amounts

- More complex user interface

Bitcoin ATMs (like Coinme):

- Immediate cash access (minutes)

- No bank account required

- Simple, guided interface

- Convenient physical locations

- Higher convenience for rapid access to cash

Exchanges typically suit those converting larger amounts who don't need immediate access to funds, while ATMs are ideal when speed and convenience are priorities.

Is there a limit to how much Bitcoin you can cash out?

Yes, cash-out limits depend on several factors:

- Verification level - Higher verification tiers allow larger transactions

- Service provider - Each company sets their own limits

- Method used - ATMs typically have daily limits, while exchanges may have higher monthly limits

- Regulatory restrictions - Limits may be imposed by local regulations

Coinme's daily limits vary by verification level and state regulations. For large transactions exceeding standard limits, exchanges with OTC (Over-The-Counter) desks or wire transfer options may be more suitable.

How can I avoid scams when cashing out Bitcoin?

Protect yourself when cashing out Bitcoin by:

- Using only licensed, established providers with positive reviews

- Verifying the legitimacy of ATMs through official websites

- Being wary of offers that seem too good to be true

- Never sharing your private keys or seed phrases

- Conducting test transactions with small amounts first

- Double-checking all wallet addresses before confirming transfers

- Using secure, private internet connections for transactions

Coinme's regulatory compliance and long-standing reputation in the industry make it a trusted choice for safely converting your Bitcoin to cash.

What alternatives are there to cashing out Bitcoin?

Before cashing out, consider these alternatives:

- Bitcoin debit cards - Spend Bitcoin directly without fully cashing out

- Direct merchant acceptance - Use Bitcoin for purchases at accepting businesses

- Bitcoin-backed loans - Borrow against your Bitcoin without selling

- Crypto interest accounts - Earn interest on holdings rather than selling

- Stablecoins - Convert to USD-pegged cryptocurrencies for stability without leaving the crypto ecosystem

These options allow you to access value or stability without completely exiting the cryptocurrency market.